Life is laden with shocks, and not usually an excellent of these. If you find yourself in a situation the place you you prefer an enormous amount of cash to pay for a huge costs, following deciding to tap into the fresh guarantee of your house is be a sensational option. One method to accomplish that is through getting property collateral loan. In this post, we’ll discuss the new ins and outs of household collateral financing, the way they functions, and just how you could qualify for that.

What’s a property collateral financing?

House guarantee can be described as the percentage of your property you have paid off your own share regarding possessions, instead of the loan providers. Quite often, home equity builds throughout the years to lower their mortgage balances otherwise incorporate worthy of to your home.

You may have can get heard about anyone taking out fully an additional mortgage on the domestic because that is basically exactly what a property security financing is actually. It is that loan which allows one borrow against the new property value your house. At Welch County Bank, we frequently hear users wanted property guarantee loan manageable to pay for renovations, scientific debts, or perhaps to shelter college tuition.

Home security financing is actually attractive forms of finance as they are generally available at straight down interest rates than simply handmade cards or private money. Lenders feel comfortable offering you all the way down rates while they remember that for those who end using these types of funds, they’re able to foreclose on your home.

How can home guarantee money really works?

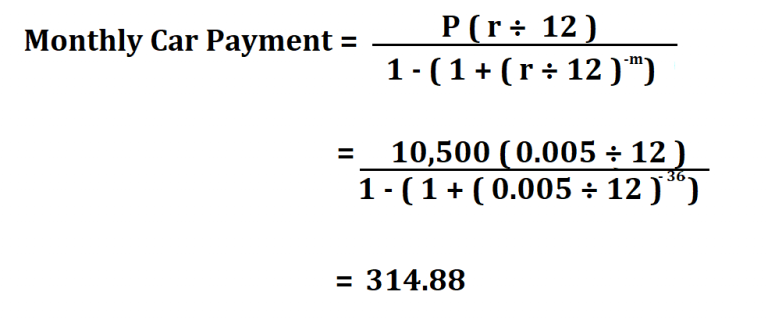

Family collateral money performs in the same way your financial did when you initially ordered your home. The money on financing are paid inside the a lump sum payment for your requirements, enabling you to utilize it as you need so you can. Just after finding the money, you’ll begin making fixed, monthly payments so you’re able to pay back the loan.

What are the advantages of choosing house guarantee loans? Which are the drawbacks?

Family equity positives are simple and you will direct. He has got advantages such as for example lower interest rates including income tax benefits that allow that deduct mortgage attract with the house security financing otherwise credit lines.

The latest disadvantages to help you house collateral fund would be the borrowing will set you back. Make sure to take note of the apr (APR), which includes their interest together with other loan costs. Yet another disadvantage in order to domestic collateral finance will be the enough time-name risk of losing your residence if you cannot build your repayments right after which foreclose on your own home. On top of that a disadvantage to family guarantee funds is the power to misuse the cash. It is critical to stick to a monetary package you to guarantees you do not live outside of the form.

How do you generate domestic equity?

Family equity ‘s the difference between your residence’s economy worth and your financial balance. With that said, there are ways in which you can increase your residence collateral.

- When you help make your mortgage payments per month you slow down the an excellent balance on your mortgage, thus building domestic security. You may also build a lot more home loan principal repayments to make guarantee faster.

- After you generate home improvements, you improve property’s worth and this operates to raise your house guarantee. When you find yourself interested in learning about what renovations improve your property’s well worth, please below are a few the blogs, 5 Home improvement Systems for additional Selling Well worth.

- Whenever worth of rises, their security increases also!

How to qualify for property collateral loan?

Qualifying getting a property collateral loan are the same technique to being qualified for the first mortgage. Or even think of far about the procedure away from buying your very first installment loan Illinois family, feel free to here are a few all of our article entitled What to anticipate When buying Your first Household. Their lender will require files away from you such as for example evidence of a position, plus suggestions of expenses and you will assets. They may in addition to inquire about you to definitely has actually:

- Two years’ value of W-2s or tax returns.

- The current shell out stub, having year-to-date earnings indexed.

- Statements for everyone bank account and you may possessions.

- Personal debt details when it comes to handmade cards or any other money.

Their lender’s tasks are when planning on taking all the information you have got given them and see exactly how much security you may have in your home, which is the percent of your property that you very own downright. This security assists you to decide how far money you can be acquire. Extremely lenders simply allow you to use to 85% of the residence’s guarantee.

- The degree of your home is worth X new percentage of domestic equity youre permitted to borrow how much cash you still owe on your household.

Such as, in the event the home is well worth $2 hundred,000 and you are permitted to obtain as much as 85% of your property guarantee, but you continue to have an effective $100,000 harmony on your home loan.

- $3 hundred,000 X 0.85 = $170,000

Before you apply for your mortgage, we highly recommend which have figures in writing for how much need in order to use, and you will what you should make use of the currency to own. Simply obtain doing you prefer as you will feel buying that it mortgage more a thorough-label.

What’s the difference between a house collateral mortgage and you may good home security personal line of credit?

Domestic guarantee loans and you will domestic guarantee lines of credit are usually mislead. He could be similar alternatives because both of them enable you to borrow from the worth of your property, however they are in fact totally different out of one another.

Property equity fund function eg antique mortgage loans, whereas a home equity credit line works such as for instance a credit credit. Family collateral lines of credit generally speaking make you a period of day you can draw security for your home, as well as have variable interest levels.

If you aren’t sure which is right for you, the borrowed funds officers on Welch State Financial waiting to talk to you personally. They are able to make it easier to get a hold of that can work best with your circumstances.