Eligible expenses is financed using either an initial Draw PPP Mortgage otherwise Second Draw PPP Loan are exactly the same while the prior to, and additionally payroll, lease, protected financial attract, and resources

Brand new Chairman closed brand new stimuli guidelines into the laws toward . The fresh rules, the economical Aid to help you Difficult-Struck Smaller businesses, Nonprofits, and you may Spots Operate, P. The economical Help Work authorizes financing out-of $284.5 mil to have PPP fund, and you can which has $thirty-five mil to possess basic-time individuals. The us Small business Government (SBA) and also the You Treasury also awarded the fresh new suggestions interpreting the brand new brand new rules.

The fresh SBA/Treasury information, create when it comes to several interim last legislation, individually address contact information the prerequisites and you may issues for borrowers which look for their basic PPP loan (Very first Draw PPP Financing(s)) and then have borrowers one to currently acquired good PPP loan when you look at the 2020 and which may now qualify for a supplementary and you will 2nd PPP mortgage (Next Mark PPP Financing(s)).

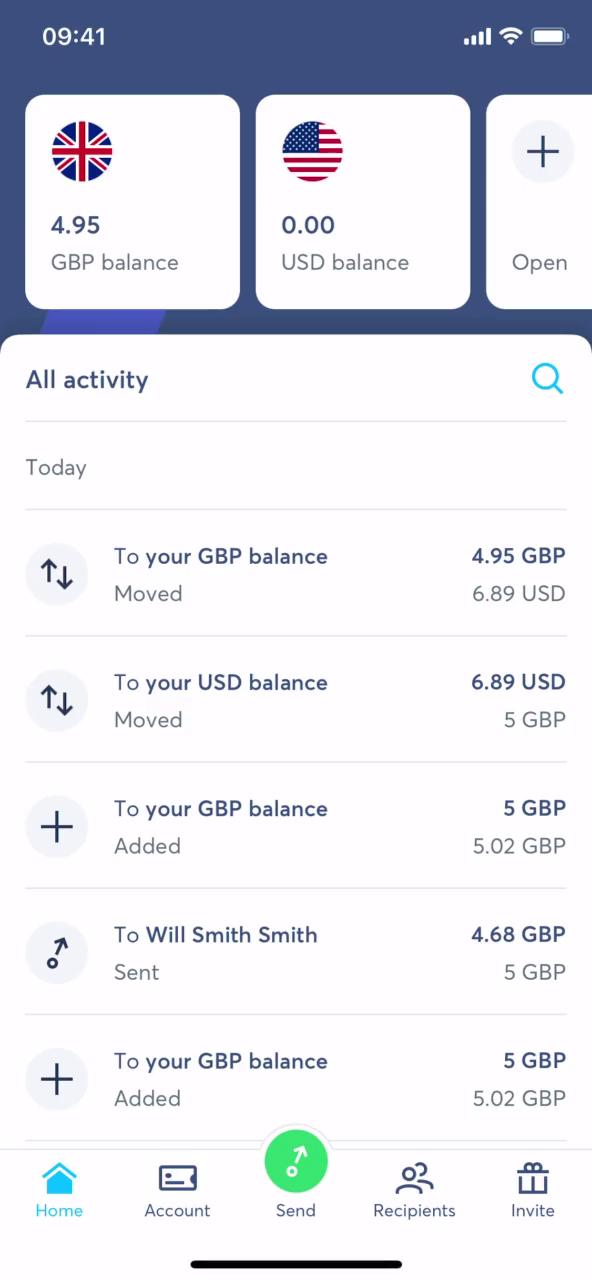

Beginning , Consumers who seek an initial Mark PPP Financing under the new laws can put on courtesy neighborhood creditors only permitted to make Basic Mark PPP Money. Consumers who search a second Mark PPP Mortgage elizabeth people financial institutions birth . PPP funds under the the fresh legislation will be open for everyone most other using loan providers during the a night out together as calculated and which will stay unlock using .

The newest SBA plus by themselves create suggestions, called Recommendations on Accessing Financial support having Fraction, Underserved, Seasoned and Women-Had Providers Inquiries, made to finest assist minority, underserved, veteran, and you may feminine-had businesses into the applying for and obtaining an excellent PPP mortgage.

The commercial Services Operate and associated SBA/Treasury pointers authorizes consumers exactly who didn’t found an initial PPP loan to today receive a PPP financing. Since before, the maximum PPP financing is $10 million. The brand new debtor need to have been in procedure towards (spending payroll), and become in one or even more of your following groups:

The law and you can associated SBA/Treasury suggestions in addition to lets borrowers exactly who already received a first PPP to get a second and extra PPP mortgage in which the debtor has:

- Firms that apply no more than five-hundred personnel, or that are otherwise qualified significantly less than money-depending otherwise alternative staff member-dimensions conditions towards sort of team or industry, and you may and specific Inner Cash Code Point 501(c) non-funds organizations (age.g. churches).

- Casing cooperatives, qualified Part 501(c)(6) teams (such as organization leagues, chambers out-of trade and visitor bureaus), otherwise an eligible appeal income business, using their only about three hundred team and you will that do not located more than 15% off invoices out of lobbying.

- Separate designers, eligible thinking-working someone, or best proprietors.

- Reports communities, having only five-hundred teams each location, which might be most-owned otherwise controlled by an NAICS password 511110 or 5151 providers or not-for-finances public sending out entities which have a trade otherwise business less than NAICS code 511110 otherwise 5151.

- Resorts, resorts, and you will food (that have NAICS rules beginning with 72) and no over 500 personnel per real place.

Specific people and you may groups continue to not be qualified to receive a good PPP loan, and now in addition to and publicly traded companies, football leagues, and you will enterprises subject to the fresh president, vice president, head out-of executive departments, and you will people in Congress (or their spouses)

The brand new laws and you may relevant SBA/Treasury recommendations also lets borrowers who currently received an initial PPP to receive one minute and extra PPP financing where in actuality the borrower has:

- 3 hundred or a lot fewer employees.

- Made use of the full quantity of their basic PPP loan to expend qualified www.paydayloancolorado.net/craig costs, and just before the second PPP loan could be acquired.

- Educated a reduced amount of 25% or higher for the terrible invoices for your 2020 one-fourth as compared towards the same one-fourth for the 2019. According to the the newest SBA/Treasury information, a debtor can also satisfy it requirement where borrower is running a business for everybody out-of 2019, and total 2020 yearly terrible receipts . Brand new SBA/Treasury guidance defines terrible receipts to include the money within the any mode received otherwise accumulated out of whichever resource, also on the conversion of products or attributes, desire, dividends, rents, royalties, charge, or commissions, quicker because of the production and you will allowances. Forgiven 2020 PPP fund commonly included in 2020 terrible invoices for those motives.

Each other Earliest Mark PPP Finance and you may Second Mark PPP fund usually end up being for up to dos.five times average month-to-month payroll can cost you (capped during the $100,000 for each and every employee annually within the 2019, 2020, or even the 12 months prior to the financing. PPP consumers with NAICS rules you start with 72 (accommodations, motels, and you will dining fundamentally) may now discover the next Mark PPP Financing up to 3.5 times average month-to-month payroll costs. Maximum to own a primary Draw PPP Mortgage is still capped on $ten billion.

The fresh new laws and you will relevant SBA/Treasury guidance as well as lets individuals whom already acquired an initial PPP to receive the next and extra PPP loan where in actuality the borrower has:

- Particular staff member defense and you will business amendment costs, also personal protective products, to help you conform to COVID-19 government safe practices advice.

Getting expenditures to-be forgivable, individuals would have to purchase at the very least 60% of the mortgage proceeds towards the payroll more an 8 or 24 months secured months.