Applying for home financing is a rigid procedure that pertains to multiple tips. People do to relieve some of the worry on the making an application for home financing is to obtain pre-accepted. Bringing pre-approved to have a home loan ensures that a lender will opinion the pointers to decide if you’d getting recognized or perhaps not. Pre-approvals do not make certain you might be approved for good financial.

Exactly what Pre-approvals would when searching for home financing

Pre-approvals become more off a precautionary level to determine exactly what residential property just be looking at. Very providers are more willing to negotiate costs which have pre-recognized somebody. This is just one of the most significant benefits associated with delivering pre-recognized.

Whenever you are in search of bringing pre-recognized to possess a mortgage, there is certain important information you should know. Below, we’ll offer all the info regarding why you should know taking pre-acknowledged to possess a home loan.

How bringing pre-approved having a mortgage performs

Before getting pre-acknowledged to have a mortgage, there are a few things you need to do. First, you need to feedback your existing credit rating and you can financial obligation-to-money proportion. This can leave you a precise check out exactly how much house it’s possible to afford.

Of many lenders like to see at least FICO rating away from 620 just before also given giving the job. The low their rating are, the more advance payment are expected initial at that time out of closure. Borrowing from the bank is just one of the important products you to determine the pre-recognition potential.

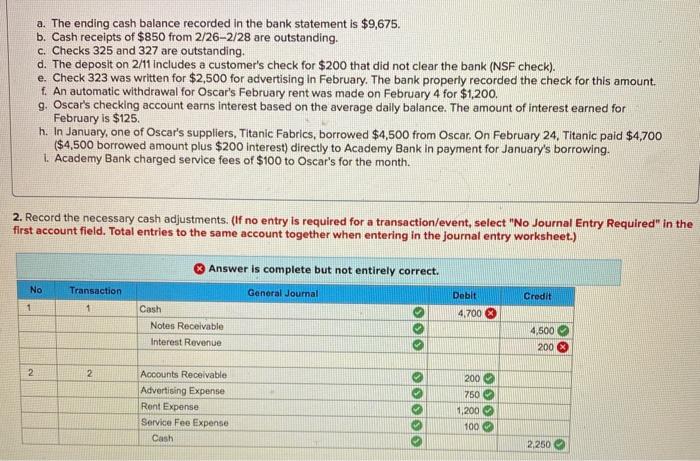

? Evidence of A position- before every loan providers agree you, they’re going to want to see evidence of your own employment. You can utilize W-2 otherwise spend stubs comments to prove your income. The more your income matches your desired loan amount, the higher your acceptance chances are. ? Proof of Assets- you really need to ensure your own property before any home loan company tend to take you undoubtedly. You’ll need to promote info of finance and you may capital accounts. ? Proof of Income- loan providers would want to see your past year’s taxation statements and all other data files which can confirm your own revenue stream. So it adds even more safety for lenders against borrowers exactly who standard. ? Standard Documentation- you’ll want to render information that is personal about you, like your public defense matter and you can license at the closure.

Advantages of taking pre-approved getting home financing

An important advantage of delivering pre-acknowledged to possess a home loan is you enjoys place limits. Home loan pre-approvals meet the requirements your for a certain amount borrowed; without it, you could potentially spend lots of time for the money that you never ever be eligible for first off.

Individuals Along with Query

Q: How long will it sample get pre-recognized to have a home loan? A: normally, it takes merely step one-3 days total to get a choice on your mortgage pre-approval app. The procedure takes expanded, depending on one issues that arise throughout running.

Q: What you should do prior to getting pre-recognized to own home financing? A: Before applying having home loan pre-recognition, you really need to follow a number of actions. Basic, rating a totally free credit history and you may review the money you owe. Next, plan out your personal and you may financial information. Eventually, submit your own mortgage pre-recognition application.

Q: Can financing become declined after pre-acceptance? A: sure, even with bringing pre-accepted, you could remain refused a home loan. The pre-acceptance techniques is just an effective pre-emptive measure for you to determine how much family you could manage.

Focusing on how providing pre-recognized to own a home loan functions

To help make the procedure of buying your 2nd domestic smooth and you can easy, get pre-approved. Use all of the guidance in this post http://www.cashadvancecompass.com/installment-loans-ia/birmingham/ to help go in the procedure. So, you can begin residing your family now! Hoping to get accepted for a loan? Contact Top priority Credit right now to start.