Lender’s or Credit Partner’s Revelation regarding Terminology:- Lenders and financing people youre connected to will provide records containing all the charges and speed advice pertaining to brand new financing offered, and additionally any potential charge to possess late-costs and statutes lower than that you could become greeting (when the allowed by applicable law) to re-finance, replenish otherwise rollover your loan. Financing charges and interest levels decided exclusively because of the bank otherwise lending spouse based on the lender’s otherwise credit lover’s inner procedures, underwriting conditions, and you will applicable rules.

Minimal amount borrowed having a subject Mortgage inside the Ca is $ten,600

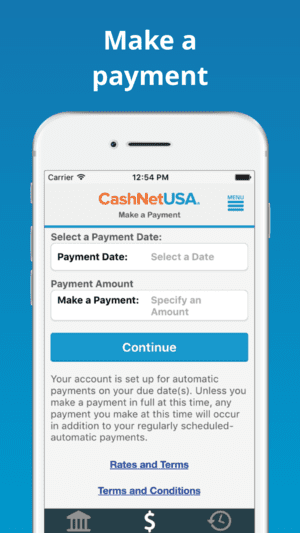

Please note one to shed a cost or making a belated fee can also be negatively cash advance impact your credit score. To guard yourself and your credit history, make sure you only undertake mortgage words that one may manage to settle. If you’re unable to build a payment on time, you need to contact your loan providers and you may lending couples quickly and speak about how to handle later repayments. Loan recognition as well as your amount borrowed derive from lender conditions about your credit, the state of the car, as well as your capability to make monthly payments. It will cost mortgage loan (APR) away from 32%-%, in the California and you will payment conditions may include 24 to forty eight days. The minimum loan amount are $dos,501.

Applicants into the California might also be billed a management fee one to ranges out-of 2 so you’re able to 5% of one’s overall count funded. Such money carry high-interest levels, and you may a lender can repossess your car or truck for folks who fall behind on your loan responsibility. Make sure your bank are authorized by the all requisite regulatory providers. Be certain that he has a ca Finance Lenders Laws License as required because of the Agency off Economic Coverage and you can Development. This new chart and you will resource advice revealed below is a keen illustrative advice of your total cost to have a concept loan. The latest Apr below are determined based on equivalent-duration cost periods. The applications are subject to appointment Lenders’ credit conditions, which includes getting appropriate property while the collateral. Users need to have indicated the capability to repay the loan. Not all candidates is recognized.

The application procedure could take four (5) moments doing. On end, conditional recognition can be considering pending post on documentation. Funding date is dependent on the time from final recognition adopting the bill and you will writeup on all necessary data files and you can signing, just before 5 PM PST for the a corporate day. The newest Apr (APR) try 32.9% having a repayment several months ranging from 24 so you can forty-eight weeks. For example, financing away from $10,750 that includes an origination commission out-of $75, that have an annual percentage rate of thirty two.9% and you can an expression out of three years, can lead to a monthly payment off $. dos An automatic fee and you will interest rate reduction arise for each few days as much as an overall notice cures rate from 20%, when you are your loan match all the following eligibility requirements: (1) the loan must be below a month overdue from the most of the minutes, (2) the loan dont was basically changed, (3) the car don’t was indeed repossessed, and you can (4) the mortgage usually do not have reached the modern readiness date. When the at any time the loan cannot fulfill every one of the above mentioned qualifications standards, the borrowed funds will no longer be eligible for one automated payment and you can attention fee area prevention.

Late Payments Damage Your credit rating

U . s . PATRIOT Act Find: Information Throughout the Beginning Another type of Account To simply help government entities battle the fresh financing of terrorism and money laundering circumstances, Government laws requires all the loan providers to obtain, verify, and you may record guidance that identifies differing people just who opens an account. What this implies to you: Once you open an account, we’re going to inquire about your title, address, big date regarding birth, or any other pointers that will enable me to choose you. We could possibly and inquire observe your own driver’s license or any other determining data files. When you use a screen reader and so are having problems with this particular web site, excite name 951-465-7599 to possess recommendations.

By the distribution your details via this amazing site, you are authorizing Getautotitleloans and its particular lovers to accomplish a card look at, which could were confirming your societal shelter matter, driver’s license amount, or other identification, and you may a review of your own creditworthiness. Borrowing from the bank checks are usually performed of the one of the major borrowing from the bank bureaus instance Experian, Equifax, and TransUnion, in addition to range between alternative credit bureaus such as for example Teletrack, DP Bureau, or anyone else. Additionally you authorize Getautotitleloans to fairly share your details and credit rating that have a network off accepted lenders and lending lovers.