A money-aside re-finance into the FHA shall be a terrific way to leverage security in your home. However, would you qualify? Is all you need to understand

- What’s an earnings-out refinance FHA?

- Ought i rating a profit-aside refinance to your an FHA loan?

- Is an earnings-out re-finance FHA worthwhile?

- Cash-away refinance FHA: closure viewpoint

Due to the fact a resident, by far the most worthwhile resource you individual is probable your residence. If you have paid a lot of your own mortgage, additionally be in a position to use more funds having major expenses. Such commonly were major home home improvements otherwise expenses for your college students.

That’s where an FHA dollars-out refinance will come in. FHA means Federal Casing Administration, and it is one way to leverage the latest guarantee on the domestic.

On this page, we shall examine exactly what a funds-away refinance FHA is, the way it works, and who’s qualified. We have found all you need to learn about a keen FHA dollars-aside refinance.

What exactly is a cash-aside re-finance FHA?

An FHA cash-away refinance is when you pay off your current mortgage with a unique, larger financial that is covered because of the Government Property Management otherwise FHA.

The level of the higher mortgage is dependant on the amount from collateral you have got gathered of your home. Moreover it includes extent you still are obligated to pay on your own existing mortgage and how far more money you want.

Cash-away refinance FHA: how it functions

You can make use of a keen FHA dollars-aside re-finance when you yourself have accumulated home collateral, and therefore your house will probably be worth more you borrowed on the mortgage.

When performing a cash-away refinance, you take away a special financial for more currency than simply you owe on your own old mortgage, that’s then repaid. The mortgage lender next provides you with the difference because the a lump share and can be taken in style.

An enthusiastic FHA dollars-away refinance works likewise, but new finance was covered by FHA. Since it is government-backed, you are eligible for straight down rates than you may score along with other refinancing solutions. You might actually https://paydayloanalabama.com/wilton/ be considered if for example the credit score is less than finest.

Cash-away re-finance FHA: example

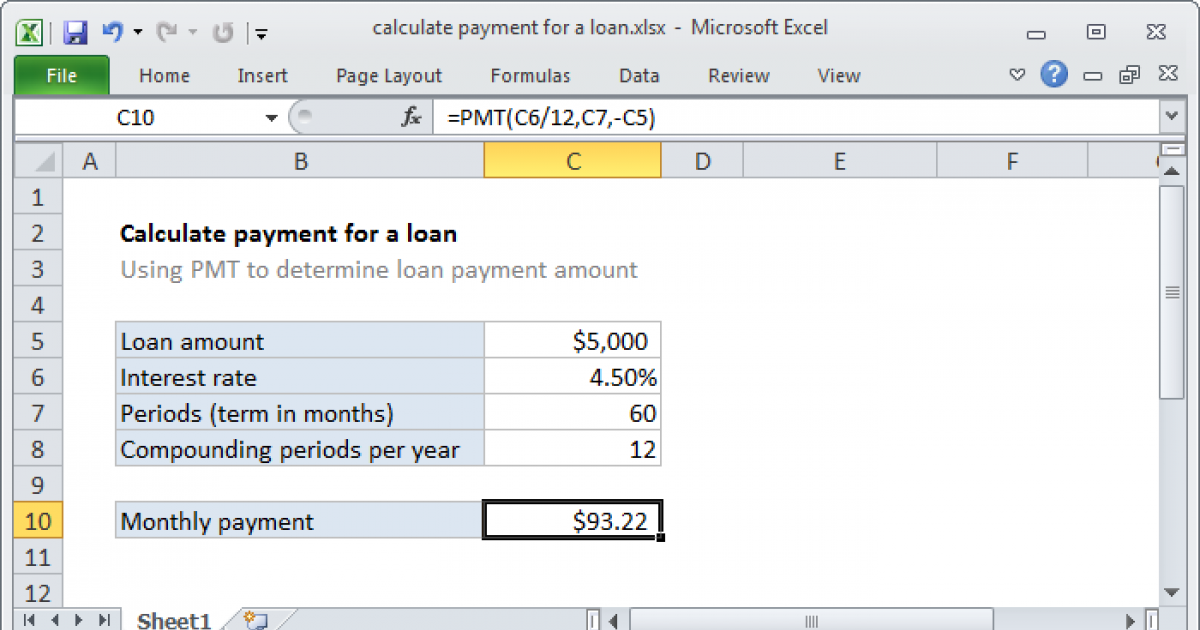

To grant an idea of exactly how an enthusiastic FHA dollars-aside refinance functions, let us take a look at a good example. State your debt $2 hundred,000 on the latest mortgage and you can household assessment has computed this new home is well worth $eight hundred,000. If you had an enthusiastic FHA dollars-out refinance, you could obtain to 80% of the home’s well worth, or $320,000.

For many who expected $100,000 having home improvements, you’d undo a different sort of home loan application process, as you did for the very first mortgage, to have an effective $3 hundred,000 mortgage alternatively. If recognized, $2 hundred,000 of these would go towards the paying their past mortgage. And you will as an alternative, you will start making money on your the fresh $3 hundred,000 home loan every month.

Just like any particular refinancing, you ought to also consider settlement costs. This is just a different foundation to adopt should you decide so you can roll people expenditures to your brand new home mortgage.

Cash-aside refinance FHA: requirements

The latest FHA keeps lowest conditions to own FHA financing. This type of minimal standards include FHA dollars-aside re-finance. However, FHA loan providers can also place her requirements into the introduction towards FHA standards.

Credit score

FHA loans is actually prominent to possess enabling credit ratings as little as 500. To own FHA cash-away refinance, however, you want a top credit history to find the best price. Though some mortgage lenders usually approve a credit score because the lowest since the 620, a minimal pricing try arranged to own borrowers who have a card score of at least 740. Its best if you improve your credit history before applying for a keen FHA cash-out refinance.