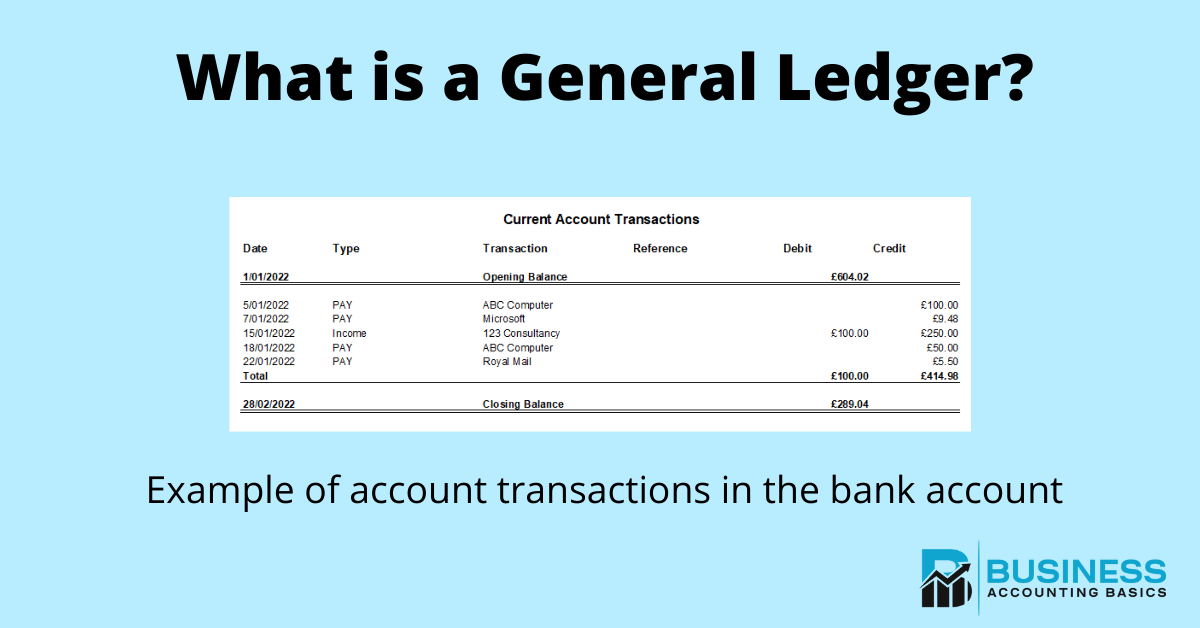

In these circumstances it is common to split off sections of the main ledger into separate subledgers. The next line shows the headings used for each of the ledger accounting transaction entries. Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond.

Step #1: Gather source documents

- For a small business, this could be thousands of lines and a larger business could have tens of thousands of lines.

- Although there are tools that automatically categorise these transactions, like bank integrations, it’s still important to know the basic components of general ledger accounts.

- It serves as the backbone of your accounting system, organizing your transactions into various accounts such as assets, liabilities, and revenue.

- Having an accurate record of all transactions that have taken place within a single point in time will ensure your financial reporting is done correctly.

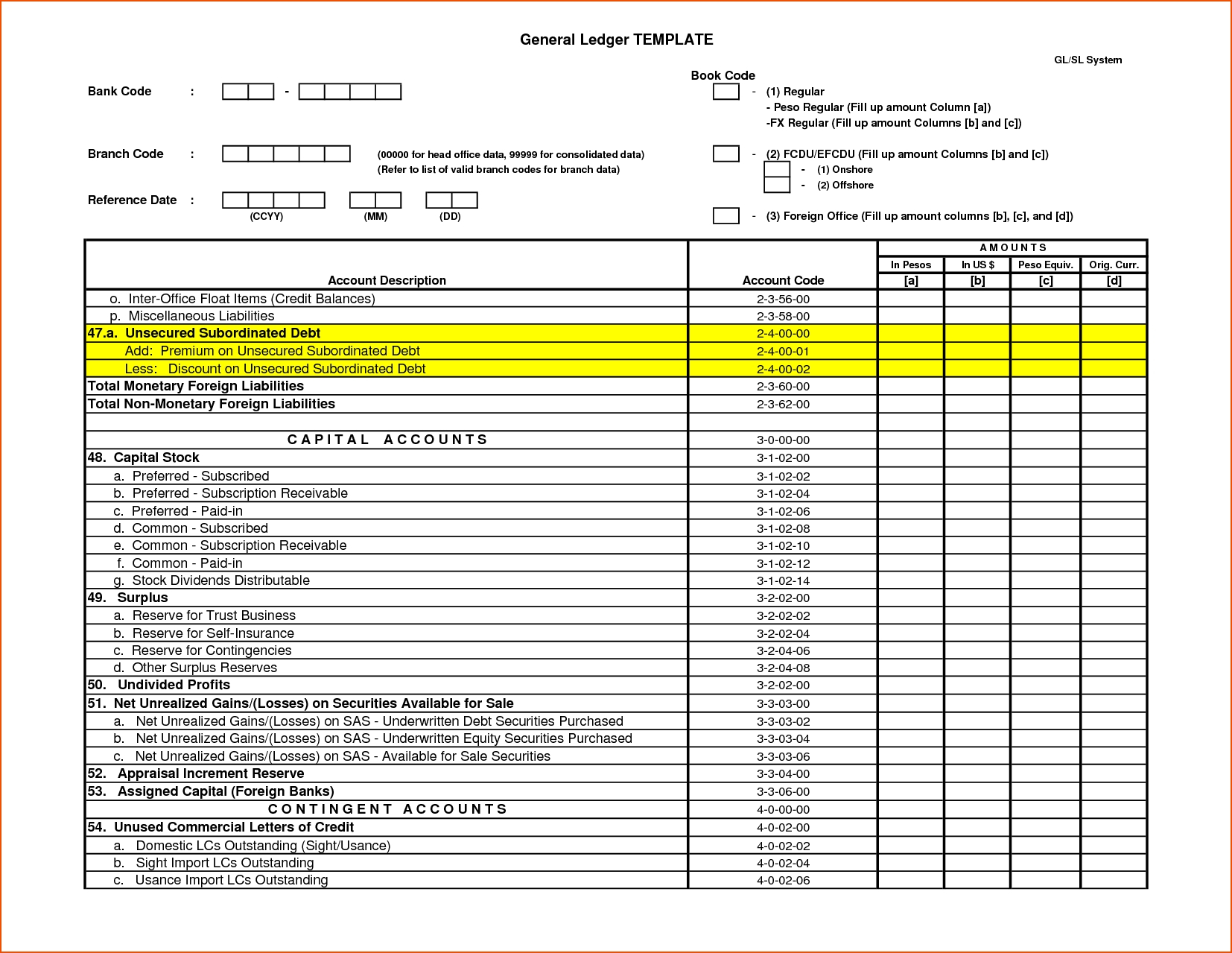

You can refer back to the details regarding the sales made and helps you to keep track of payments that have been received or yet to be received from your customers. Here is an example of how you can transfer the journal entries to a general ledger. Next, we’ll dive into a few other financial accounting documents that are closely related to — but distinct from — the general ledger. The general ledger unemployment income is in the format of “T”, that is why sometimes it is also called “T-accounts”, which on the left side is the Debit and the right side is the Credit. A general ledger code is a unique identifier for each account in the general ledger, used to categorize transactions. Now that we’ve got the quick facts covered, let’s dive deep into general ledgers and how your business can benefit from them.

General Ledger vs. General Journal

This is because owners and the outsiders are the ones who go in for providing such resources. Current liabilities can include things like employee salaries and taxes, and future liabilities can include things like bank loans or lines of credit, and mortgages or leases. Instead, financially-minded individuals — and businesses — use ledgers to fastidiously document money that’s they’re paying out, or being paid. QuickBooks’ intuitive accounting software helps provide a comprehensive audit trail.

Table of Contents

Such an investigation helps you to avoid errors later, and, with an online accounting software like QuickBooks, such a comparison becomes a lot easier. A general ledger helps you to know the overall profitability and financial health of your business. In addition to this, the information contained in general ledgers help you to run any audits smoothly.

A General Ledger Example: Breaking Down the GL in Accounting

For this reason, general ledger is also known as the Principal Book of Accounting System. In this instance, one asset account (cash) is increased by $200, while another asset account (accounts receivable) is reduced by $200. The net result is that both the increase and the decrease only affect one side of the accounting equation. Accounts receivable (AR) refers to money that is owed to a company by its customers.

Other ledger formats list individual transaction details along with account balances. “[The general ledger] is comprised of assets, liabilities, owner’s equity, revenue, cost of goods sold and expense accounts,” said New York-based small business bookkeeper Barbara Cross. In double-entry accounting, every transaction affects at least two accounts, which helps maintain the balance between debits and credits. It operates on a double-entry bookkeeping system where every financial transaction is entered twice, as both a debit and a credit in respective accounts, ensuring the accounts always balance. Most companies have many of the same general accounts like cash, accounts payable, and retained earnings, but some companies have specialized accounts specific for their operations.

On the other hand, if the company incurs expenses, this will decrease the owner’s equity because it means there’s less money available for you to draw out. “As transactions in your business occur, they are noted in the general ledger under each account using double-entry accounting. It’s essential to have an accurate accounting of all transactions so that financial statements are correct.

For example, if you sell $100 worth of goods, you would record it in your general ledger under revenue. If you then pay $50 in operating expenses, you would record that under expenses. The general ledger will then balance these entries using the double-entry accounting system, ensuring that every transaction is accounted for accurately. A journal is used to record transactions chronologically before they are posted to the general ledger, which organizes these entries by account for financial reporting. A business owner can see any specific transaction during the period since there is a complete record.