Content

We reserve the right to withhold rewards if there is reason to suspect that a deposit is fraudulent, or that it has not been made with the intention of using it to play real money games. The offer is only available to players who have never made any real money deposit at PokerStars. The top 1 percent of taxpayers would see a higher increase of about 0.3 percent. On a long-run dynamic basis, factoring in increased economic output, after-tax income would increase by 0.4 percent overall, and by a similar amount in each income quintile.

- By doing nothing, you’ll claim 80percent (60percent for 2024) bonus depreciation automatically for property that you have placed in service during the 2023 tax year.

- Since taxpayers must calculate their federal taxable income as if IRC Section 168 — relating to bonus depreciation — were not in effect, Michigan does not adopt Sec. 168.

- IHG One Rewards points purchases are processed by points.com, meaning they don’t count as a hotel purchase for the purposes of credit card spending.

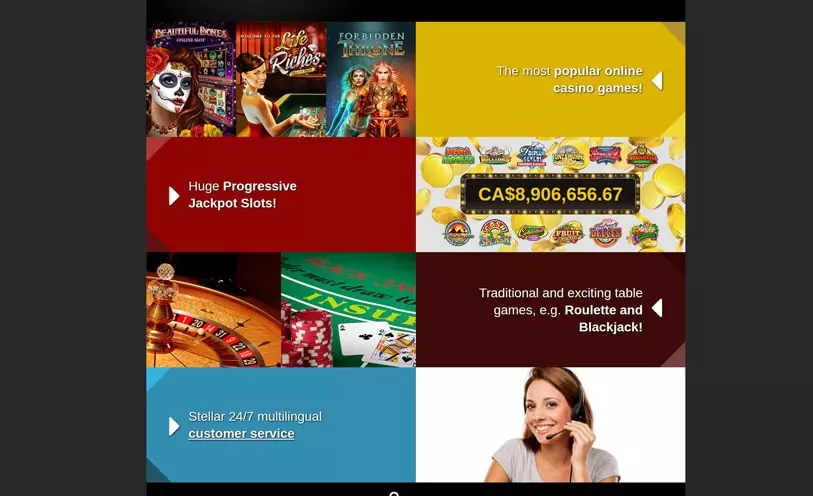

- If your selected offer comes with a bonus code, you need to enter it somewhere or send it to the casino to activate your bonus.

- You may be given a certain amount of bonus credits which can be used to play games on a casino.

- Research indicates past instances of bonus depreciation have boosted capital accumulation and employment opportunities.

The asset’s basis is not figured in reference to a basis acquired from a decedent. The asset’s basis is not figured in reference to the adjusted basis of the property when under ownership of the seller. It was created as a way to encourage investment by small businesses and stimulate the economy. Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

For example, deducting 10,000 over 10 years may not materially impact each year’s taxable income, but deducting 100,000 in a single year may reduce a company’s highest marginal tax rate. Bonus depreciation is a tax incentive designed to stimulate casinolead.ca more business investment by allowing companies to accelerate the depreciation of qualifying assets, such as equipment, rather than write them off over the useful life of the asset. This strategy can reduce a company’s income tax, which in turn reduces its tax liability.

The Tcja 100percent Bonus Depreciation Starts To Phase Out After 2022

Unless Congress enacts new tax law changes, the bonus percentage will decrease by 20percent each year over the next few years until it eventually phases out completely. On August 3, the IRS issued the first set of regulations to implement these expanded bonus depreciation rules. These proposed regulations describe and clarify the statutory requirements that must be met for depreciable property to qualify for bonus depreciation.

Can I Choose Which Assets To Claim Bonus Depreciation On?

Capital investment is critical for economic growth, and ultimately, capital investment benefits workers. Capital ranges from the simple, such as a hammer, to the complex, such as a semiconductor foundry. In general, more capital leads to more opportunities for workers. The existing U.S. tax code, however, is biased against capital investment and the bias is scheduled to worsen over the next decade. Although the IRS declined to remove the term “predecessor” from the final regulations’ definition of used property, it did decide to define the term in the final regulations.

What Counts As Qualified Property For Section 179?

Hawaii does not conform to the Tax Cuts and Jobs Act provision that provides a 100percent first-year deduction for the adjusted basis allowed for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023. Georgia does not conform to the Tax Cuts and Jobs Act provision that provides a 100percent first-year deduction for the adjusted basis allowed for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023. California does not conform to the Tax Cuts and Jobs Act provision that provides a 100percent first-year deduction for the adjusted basis allowed for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023.COYes. Arkansas does not conform to the Tax Cuts and Jobs Act provision that provides a 100percent first-year deduction for the adjusted basis allowed for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023.AZNo. Alabama conforms to the Tax Cuts and Jobs Act provision that provides a 100percent first-year deduction for the adjusted basis allowed for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023.ARNo.

Interactions With Limitation On Net Business Interest Expense

As the law stands, you can deduct up to 100percent of an asset’s cost in the year of purchase on your business taxes. Pennsylvania does not conform to the Tax Cuts and Jobs Act provision that provides a 100percent first-year deduction for the adjusted basis for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023.RINo. New Hampshire does not conform to the Tax Cuts and Jobs Act provision that allows a 100percent first-year deduction for the adjusted basis for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023.NJNo. Nebraska conforms to the Tax Cuts and Jobs Act provision that provides a 100percent first-year deduction for the adjusted basis for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023.NHNo. Florida does not conform to the bonus depreciation changes made by the Tax Cuts and Jobs Act.

Most significantly, it doubled the bonus depreciation deduction for qualified property, as defined by the IRS, from 50percent to 100percent. The 2017 law also extended the bonus to cover used property under certain conditions. You may be given a certain amount of bonus credits which can be used to play games on a casino. To convert this into real money you would typically need to bet the credits several times, as per wagering requirements, before withdrawing as cash.

Vermont does not conform to the Tax Cuts and Jobs Act provision that provides a 100percent first-year deduction for the adjusted basis allowed for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023. Virginia does not conform to the Tax Cuts and Jobs Act provision that provides a 100percent first-year deduction for the adjusted basis allowed for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023. Utah conforms to the Tax Cuts and Jobs Act of 2017 provision that provides a 100percent first-year deduction for the adjusted basis allowed for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023.VANo. Texas does not conform to the Tax Cuts and Jobs Act provision that provides a 100percent first-year deduction for the adjusted basis allowed for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023.UTYes.

No Deposit Bonuses

Investopedia does not include all offers available in the marketplace. Qualified improvement property such as leasehold improvements acquired after Dec. 31, 2017. Used in a trade or business that has had floor-plan financing indebtedness under certain circumstances.