A mortgage recast occurs when you will be making an enormous one-big date payment to reduce the financial harmony as well as your bank recalculates their monthly payment this is why. (This is certainly referred to as a lso are-amortization of your mortgage.) Their bank restructures your own payment per month agenda for the rest of your loan title to help you account for the new lump-share percentage.

Recasting your own mortgage doesn’t replace your interest rate or mortgage terminology but it can help reduce your requisite minimum monthly payment and it will save some costs in the desire along side lifetime of one’s financing.

Only a few loan providers provide recasting rather than all mortgage systems are qualified. You can usually create a swelling-share commission to decrease your dominant balance however, in the place of a recast their monthly mortgage payment perform stay the same.

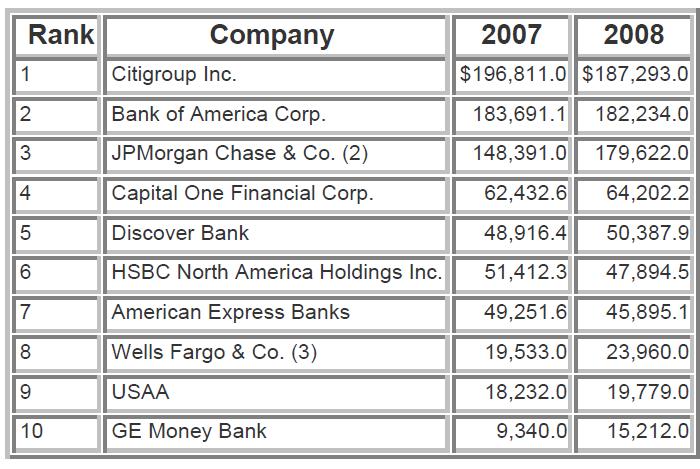

Financial recast example:

When determining whether to recast the financial, it’s best to go through the numbers to choose in the event that it is worthwhile. http://www.cashadvanceamerica.net/title-loans-ia/ Read this home loan recast example.

Within this example, new borrower might be able to obtain lender to recast the financial and also a new straight down monthly payment to have dominating and you may attention.

Is-it a smart idea to recast their mortgage?

Recasting your home loan enjoys positives and negatives. When you build a large lump-sum fee normally required for financial recasting, you could potentially reduce your payment per month and you may probably save on interest costs. And also make a swelling-contribution commission mode you might not have that money designed for issues and other costs, although not.

Including, you may also envision while making a lump-sum commission one to reduces your prominent equilibrium but not recast your own home loan and sustain their payment a similar. The advantage of and come up with a lump sum and you can keepin constantly your payment just like not in favor of recasting the loan are this may allow you to pay off your own financial faster. If you are paying out of your financial quicker it’s also possible to probably save your self far more money in interest over the life of the loan.

If you refinance otherwise recast your mortgage?

Recasting and refinancing try each other choices that might help your lower your own monthly payment and you can save very well desire. Recasting means one keeps a lot of cash to make a one-big date payment and will not allows you to replace your attention price and other mortgage words, however.

Refinancing will give you the ability to decrease your interest and you will possibly reduce your percentage or reduce focus. Refinancing doesn’t require one provides a good number of bucks even though you may have to pay closing costs while will need to meet your lender’s borrowing, income, and you will economic requirements to truly get your re-finance acknowledged.

Envision one another selection and decide which is the right choice for you. Also remember by refinancing, the entire funds costs you have to pay is large over the longevity of the mortgage.

How frequently can you recast their financial?

There was generally not a limit so you can how often you can also be recast your home loan, but recasting the mortgage usually includes a fee. This payment is multiple hundred cash and really should getting factored in the choice in order to recast. When you yourself have already recast your own mortgage, you happen to be capable pay-off your home loan early from the making use of your additional offers to spend off your financial dominant.

Recasting with Independence Financial

Are you presently a recently available Liberty Home loan customers which have questions relating to if youre permitted recast the home loan? Va, FHA, and you can USDA funds aren’t qualified to receive recasting. Traditional fund will likely be eligible for folks who satisfy certain requirements. Name a Customer service Agencies at the 855-690-5900 to talk about recasting.